Friday, March 18, 2011

jets to benghazi.

one small step for liberalism, one giant leap for multilateralism. finally.

oh and speaking of multilateralism...

phew! what a week.

Tuesday, March 1, 2011

death and taxes.

it's tax time and it's time to correct some abounding misperceptions! i think the best way to do is just post a little tit for tat i had with a misperceiver who quoted this...

From the US Treasury and Office of Tax Analysis:

# In 2002 the latest year of available data, the top 5 percent of taxpayers paid more than one-half (53.8 percent) of all individual income taxes, but reported roughly one-third (30.6 percent) of income.

# The top 1 percent of taxpayers paid 33.7 percent of all individual income taxes in 2002. This group of taxpayers has paid more than 30 percent of individual income taxes since 1995. Moreover, since 1990 this group’s tax share has grown faster than their income share.

# Taxpayers who rank in the top 50 percent of taxpayers by income pay virtually all individual income taxes. In all years since 1990, taxpayers in this group have paid over 94 percent of all individual income taxes. In 2000, 2001, and 2002, this group paid over 96 percent of the total.

Treasury Department analysts credit President Bush's tax cuts with shifting a larger share of the individual income taxes paid to higher income taxpayers.

America’s lowest-earning one-fifth of households receives roughly $8.21 in government spending for each dollar of taxes paid. Households with middle-incomes receive $1.30 per tax dollar, and America’s highest-earning households receive $0.41 per tax dollar;

and my response:

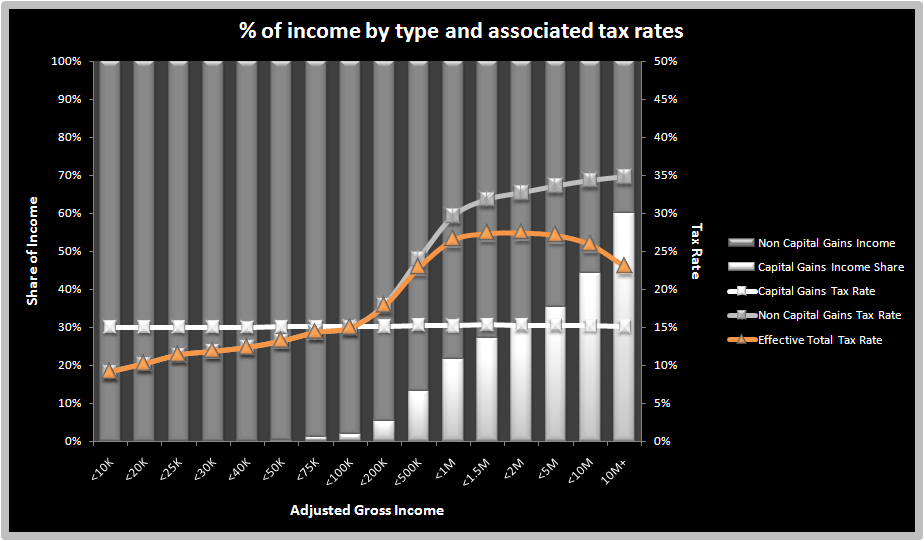

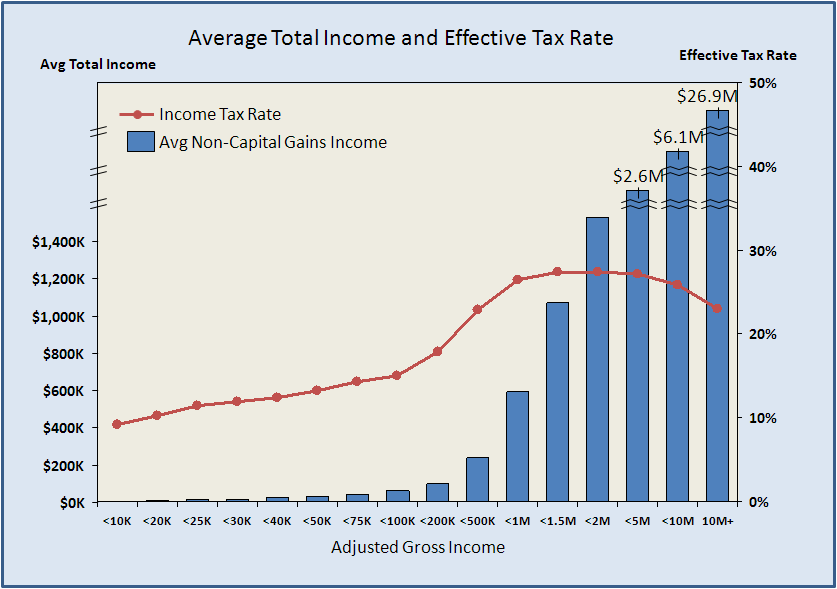

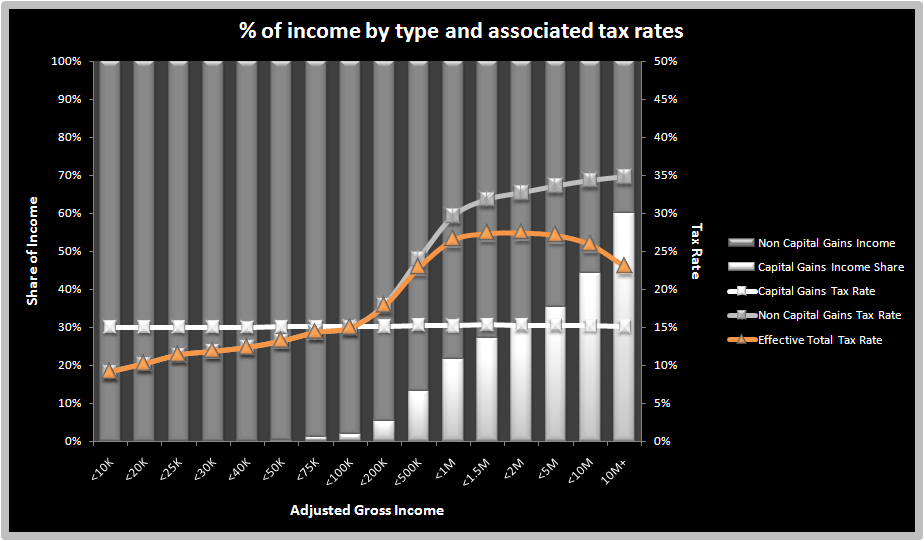

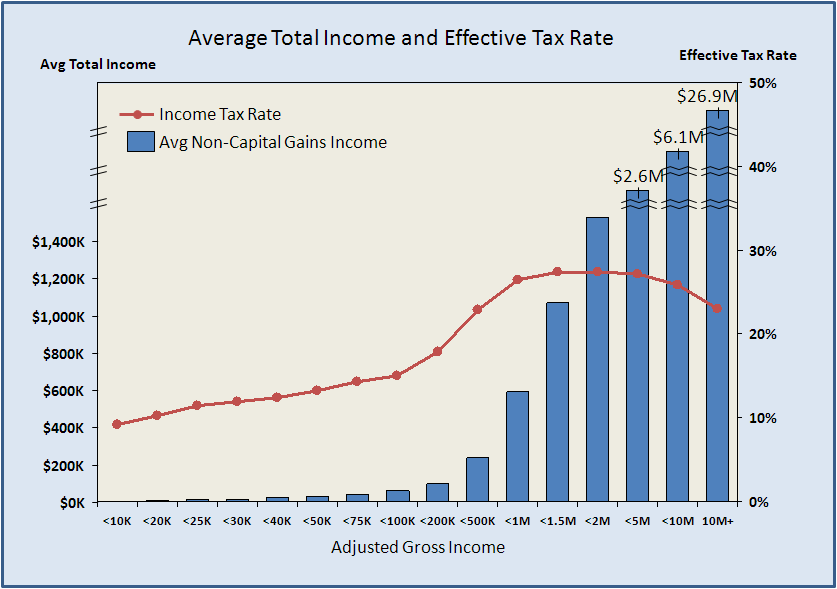

ok i think i see what you're missing here. what you quote uses the irs definition of income tax. yes, as far as "income tax" goes, it is purely progressive, and you pay more as you make more. what you don't see is that income tax isn't the only tax people pay. that misses the taxes on income from capital gains, and thus misses the bigger picture. that's why i went out and found the bigger picture for you...

don't worry, it's a common mistake. but any economist will tell you, there is no disputing that according to *effective* tax rates the us tax code is regressive in favor those who make $1.2 million+. effective tax rates are a much truer measure of tax burden than statutory tax rates, and it's manipulated all the time: http://seekingalpha.com/article/92485-statutory-vs-effective-tax-rates

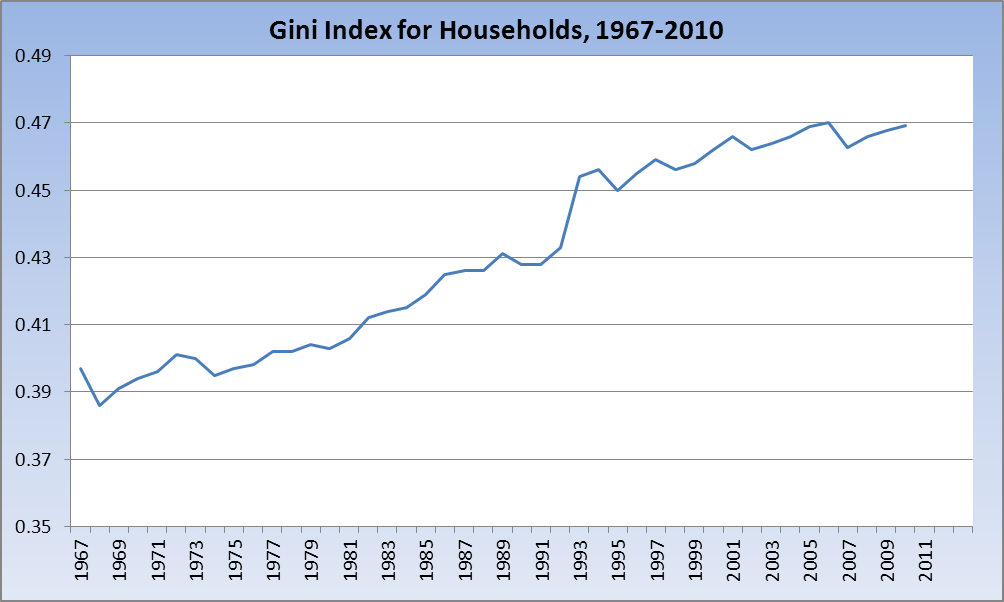

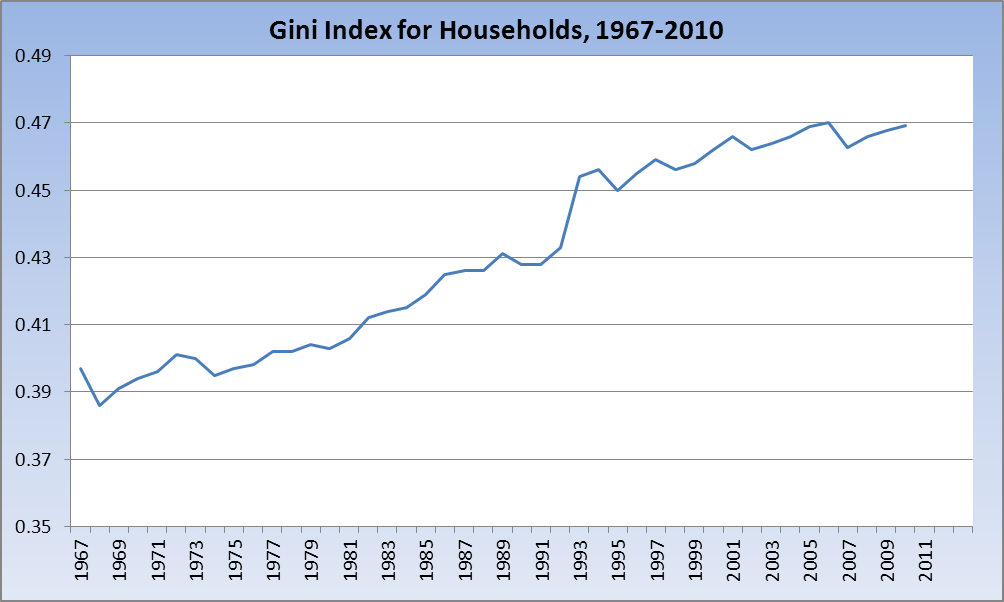

also, you should be careful with those figures you quoted. they may actually be more a reflection of growing income inequality than a progressive tax system. think about it this way: imagine the top 5% made literally *all* the income and everyone else made literally 0. see how amazing the quotes could be now? the rich pay all taxes! oh how noble of them!

p.s. "The wealthier you are, the greater a percentage of your wealth goes to the gov't." nope. not once you make 1.2 million+. another fun tidbit, that first chart shows how effective tax rate dips after 2 million "gross income." but again, details details... gross income is before expenses. (see: gross vs net.) in actuality, it starts to dip after 1.2 million net income...

isn't critical reasoning fun?

and as always... http://www.wallstats.com/deathandtaxes/

From the US Treasury and Office of Tax Analysis:

# In 2002 the latest year of available data, the top 5 percent of taxpayers paid more than one-half (53.8 percent) of all individual income taxes, but reported roughly one-third (30.6 percent) of income.

# The top 1 percent of taxpayers paid 33.7 percent of all individual income taxes in 2002. This group of taxpayers has paid more than 30 percent of individual income taxes since 1995. Moreover, since 1990 this group’s tax share has grown faster than their income share.

# Taxpayers who rank in the top 50 percent of taxpayers by income pay virtually all individual income taxes. In all years since 1990, taxpayers in this group have paid over 94 percent of all individual income taxes. In 2000, 2001, and 2002, this group paid over 96 percent of the total.

Treasury Department analysts credit President Bush's tax cuts with shifting a larger share of the individual income taxes paid to higher income taxpayers.

America’s lowest-earning one-fifth of households receives roughly $8.21 in government spending for each dollar of taxes paid. Households with middle-incomes receive $1.30 per tax dollar, and America’s highest-earning households receive $0.41 per tax dollar;

and my response:

ok i think i see what you're missing here. what you quote uses the irs definition of income tax. yes, as far as "income tax" goes, it is purely progressive, and you pay more as you make more. what you don't see is that income tax isn't the only tax people pay. that misses the taxes on income from capital gains, and thus misses the bigger picture. that's why i went out and found the bigger picture for you...

don't worry, it's a common mistake. but any economist will tell you, there is no disputing that according to *effective* tax rates the us tax code is regressive in favor those who make $1.2 million+. effective tax rates are a much truer measure of tax burden than statutory tax rates, and it's manipulated all the time: http://seekingalpha.com/article/92485-statutory-vs-effective-tax-rates

also, you should be careful with those figures you quoted. they may actually be more a reflection of growing income inequality than a progressive tax system. think about it this way: imagine the top 5% made literally *all* the income and everyone else made literally 0. see how amazing the quotes could be now? the rich pay all taxes! oh how noble of them!

p.s. "The wealthier you are, the greater a percentage of your wealth goes to the gov't." nope. not once you make 1.2 million+. another fun tidbit, that first chart shows how effective tax rate dips after 2 million "gross income." but again, details details... gross income is before expenses. (see: gross vs net.) in actuality, it starts to dip after 1.2 million net income...

isn't critical reasoning fun?

and as always... http://www.wallstats.com/deathandtaxes/

Subscribe to:

Posts (Atom)